In a January 2008 meeting, US and Spain trade officials strategized how to increase acceptance of genetically modified (or GM) foods in Europe, including inflating food prices on the commodities market, according to a leaked US diplomatic cable released by WikiLeaks.

During the meeting, Secretary of State for International Trade, Pedro Mejia, and Secretary General Alfredo Bonet "noted that commodity price hikes might spur greater liberalization on biotech imports."

It seems Wall Street traders got the word. By June 2008, food prices had spiked so severely that "The Economist announced that the real price of food had reached its highest level since 1845, the year the magazine first calculated the number," reports Fred Kaufman in The Food Bubble: How Wall Street starved millions and got away with it.

The unprecedented high in food prices in 2008 caused an additional 250 million people to go hungry, pushing the global number to over a billion. 2008 is also the first year "since such statistics have been kept, that the proportion of the world's population without enough to eat ratcheted upward," said Kaufman.

All to boost acceptance of GM foods, and done via a trading scheme on which Wall Street speculators profited enormously.

Mass food riots in several nations ensued, as did an investigation by the U.S. Senate Committee on Homeland Security and Governmental Affairs, resulting in a finding that, yes, unrestricted speculation in food commodities caused soaring prices.

In a comment at the end of the cable, the diplomat also revealed a level of pessimism about Spain's willingness to help force GM foods on Europe:

"This was a very good substantive discussion. However, it is clear that while Spain will continue sometimes to vote in favor of biotechnology liberalization proposals, the Spaniards will tread warily on this issue given their own domestic sensitivities and other equities Spain has in the EU."

That pessimism was largely unfounded, as "Spain planted 80 percent of all the Bt maize in the EU in 2009 and maintained its record adoption rate of 22 percent from the previous year," noted a report by the International Service for the Acquisition of Agri-biotech Applications (ISAAA).

The leaked cables, amounting to over 1,300 right now, reveal US obsession with expanding the biotech market:

- One leaked cable confirms US concern with promoting GM foods in Africa, which Richard Brenneman described as "a significant item on the State Department's agenda."

- In another leaked cable describing the potential to expand US interests in "isolationist" Austria, that nation's ban on GM foods is highlighted.

- According to a leaked cable from 2007, of concern was French President Sarkozy's desire to implement a ban on GM foods in line with populist sentiment. According to GM Free Regions, France maintains its opposition to GM foods today.

- In this leaked cable, the Pope openly blamed global hunger on commodity speculation and corrupt public officials, so far refusing to support the use of GM foods. (Also see my Dec. 12 piece, "Leaked cables confirm Pope's distance from GMO debate and limited stance on bioethics."

More may be revealed in the remaining cables.

Profiteering Leaves World open to Future Price Manipulation

Food commodity speculation was enabled in 2000 by the Commodity Futures Modernization Act. Deregulation handyman Senator Phil Gramm (R-TX) introduced the bill, coauthored by financial industry lobbyists and cosponsored by Senator Richard Lugar (R-IN), the chairman of the Agriculture Committee.

Mother Jones describes the legislative climate when the bill passed:

"As part of a decades-long anti-regulatory crusade, Gramm pulled a sly legislative maneuver that greased the way to the multibillion-dollar subprime meltdown....

"Gramm's most cunning coup on behalf of his friends in the financial services industry—friends who gave him millions over his 24-year congressional career—came on December 15, 2000. It was an especially tense time in Washington. Only two days earlier, the Supreme Court had issued its decision on Bush v. Gore. President Bill Clinton and the Republican-controlled Congress were locked in a budget showdown. It was the perfect moment for a wily senator to game the system. As Congress and the White House were hurriedly hammering out a $384-billion omnibus spending bill, Gramm slipped in a 262-page measure called the Commodity Futures Modernization Act."

Not only did that Act enable the subprime meltdown that crashed the economy and put tens of millions into foreclosure, it also enabled Wall Street investors to artificially spike the price of food.

"Bankers had taken control of the world's food, money chased money, and a billion people went hungry," Kaufman clarified.

After a year long investigation, he confirmed that price hikes in food from 2005 thru the peak in June 2008 had nothing to do with the supply chain, but instead occurred as a result of a Wall Street investment scheme known as Commodity Investment Funds. The first to develop the idea was Goldman Sachs, which took 18 different food sources, including cattle, coffee, cocoa, corn, hogs and wheat, and created an investment package. Kaufman explains:

"They weighted the investment value of each element, blended and commingled the parts into sums, then reduced what had been a complicated collection of real things into a mathematical formula that could be expressed as a single manifestation, to be known thenceforward as the Goldman Sachs Commodity Index. Then they began to offer shares."

(Kaufman summarizes his report in this June 2010 interview by Thom Hartmann, and in this July Democracy Now interview.)

Kaufman points out that also in 2008, ConAgra Foods was able to sell its trading arm to a hedge fund for $2.8 billion. The world's largest grain trader and GMO giant, Cargill, recorded an 86% jump in annual profits in the first quarter of 2008, attributed to commodity trading and an expanding biofuels market. The Star Tribune calculated that Cargill earned $471,611 an hour that quarter.

The investment bubble burst in June 2008 and "aggregate commodity prices fell about 60% by mid-November 2008," notes Steve Suppan of the Institute for Agricultural and Trade Policy. Though the US House of Representatives introduced a regulatory bill, "legislative loopholes will exempt at least 40-45%" of such trades. Supporting the loopholes is Cargill, among other multinational corporations. Suppan concludes:

"The outlook for a sustainable and transparent financial system to underwrite trade dependent food security is not good... [T]he budget for the just launched congressional Financial Crisis Inquiry Commission, scheduled to report December 15, [2010] is just $8 million. The Wall Street lobbying budget for defeating financial reform legislation is thus far $344 million..."

The final bill was signed into law in July 2010 (summarized by the New York Times), and the Commodity Futures Trading Commission continues to issue new rules purportedly aimed at regulating financial markets. "But big banks influence the rules governing derivatives through a variety of industry groups," notes another New York Times piece.

Did the artificial price hike open EU doors to GM foods?

No, in fact ISAAA noted that: "Six European countries planted 94,750 hectares of biotech crops in 2009, down from seven countries and 107,719 hectares in 2008, as Germany discontinued its planting."

A closer look at EU member state actions on GM foods after June 2008 details some of the GM-free battle in Europe:

- In December 2008, after a ten-year hiatus, Italy agreed to open field tests of GM crops.

- The Czech Republic became the second largest grower of Bt corn in the EU in 2008, nearly doubling the acreage planted in 2007. The USDA characterized it as being an investment target not only in agriculture but also in vaccine development.

- At the EU level, "In an apparent U-turn in his attitude as one of EU executive's most GM-wary commissioners, environment chief Stavros Dimas" wrote draft approvals for two more varieties of GM corn, reported Reuters in December 2008.

- However, by September 2008, Wales, Northern Ireland and Scotland had all become GM-free, and urged the UK to do likewise.

- Though pressured by the European Commission, in January 2009 Hungary refused to lift its ban on GM foods. Its sovereign right to reject GMOs, along with Austria's, was later upheld by an EU vote with 20 member states supporting such bans.

- In March 2009, Luxembourg became the fifth EU nation to ban GM foods, following France, Hungary, Greece and Austria.

- In October 2009, Turkey banned the import of biotech products.

For updates and a more thorough history of EU actions on GM foods, see GMO-Free Europe. European states handle the issue differently than in the US, allowing regions within a nation to maintain GM-free zones. Each step a nation takes toward GM approval invariably draws regional resistance.

Biotech Crops Expand Globally in 2009

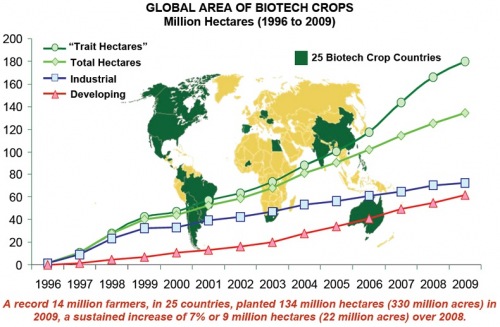

Though the strategy to hike food prices to spur European acceptance of GM foods failed, it worked elsewhere. Globally, biotech crops expanded by 7% in 2009 over 2008 figures, according to this chart by ISAAA:

In fact, ISAAA asserted GM expansion was due to the 2008 price hikes, as noted by chairman and founder Clive James: "With last year's food crisis, price spikes, and hunger and malnutrition afflicting more than 1 billion people for the first time ever, there has been a global shift from efforts for just food security to food self-sufficiency."

Poorer nations hardest hit by hunger — in Africa and South America — are more vulnerable to price hikes. But even after the geologically unusual earthquake in January, Haitian farmers rejected Monsanto's "gift" of GM seeds. However, the big push remains in Africa and China.

A Wary Future

Although it is now widely accepted that Wall Street speculation caused the food bubble, starving hundreds of millions, regulators have so far failed to curb the practices that allow international banksters to manipulate food prices.

Meanwhile, the biotech industry continues to repeat its mantra that GM food can cure world hunger. This claim is not backed by the science and it seems to hold less sway in the GM food debate, especially with the Pope recognizing what many others assert: There is no shortage of food; hunger expanded because of price hikes.

Rady Ananda holds a B.S. in Natural Resources from The Ohio State University's School of Agriculture and runs the websites Food Freedom and COTO Report.

Comments (closed)

John Rachel

2011-01-14 19:40:56

Brilliant article. Incisive but very alarming. The trend to commodify everything and absorb even the most basic items of sustenance into exotic financial instruments does not bode well on any front. When will this madness stop? Isn't there anyone in Congress who can see that this is a stake being driven into the heart of democracy and into America itself?